Sunlight Successfully Continues Dynamic Development on Planned Growth Path

Athens, Greece, 08 November 2023

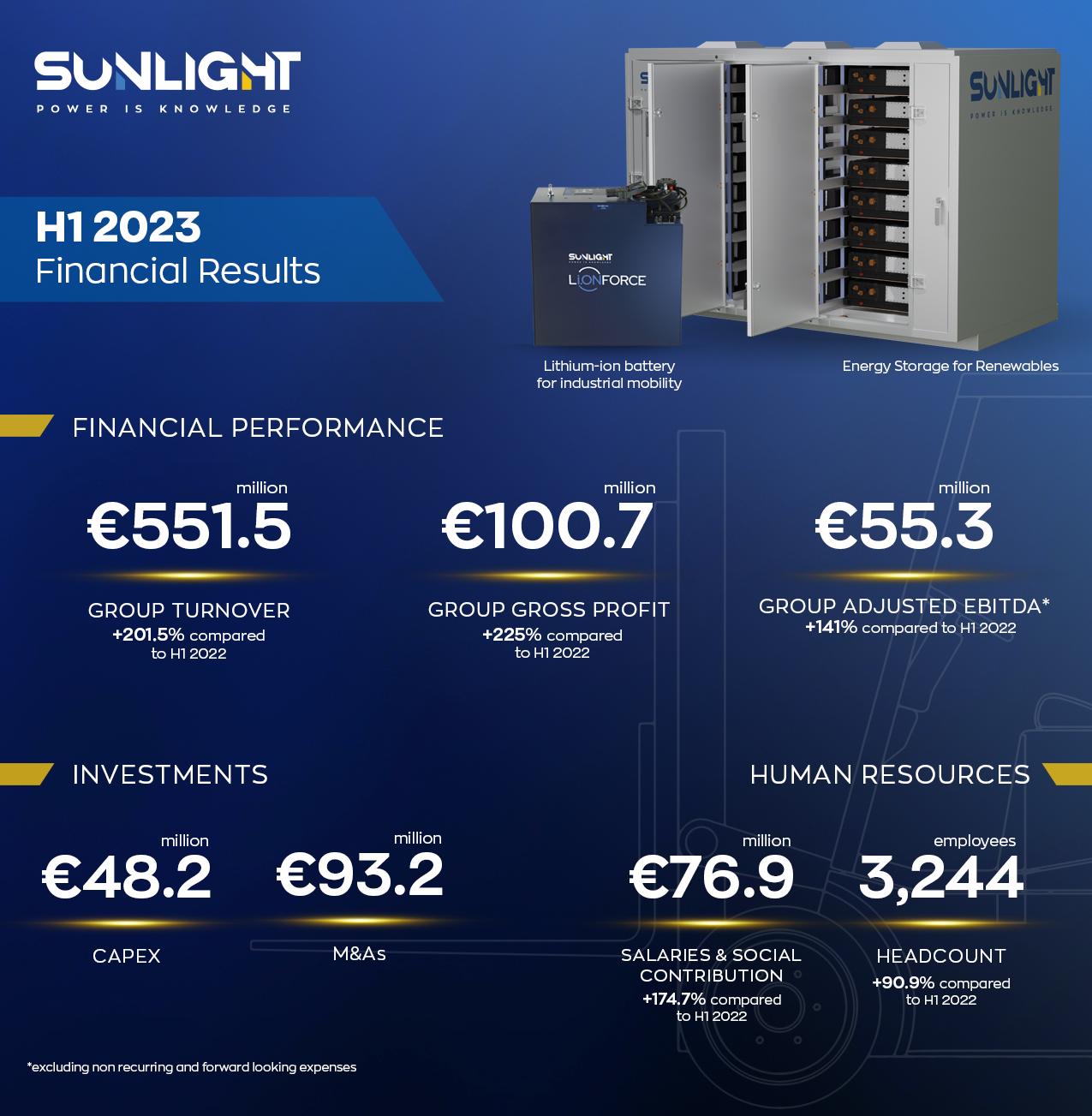

€551.5 million revenue (VS €183 million in H1 2022; 201.5% increase) with adjusted EBITDA of €55.3 million (VS €22.9 million in H1 2022; 141% increase)

Significant acquisitions across Europe create an enhanced client base and technological platform

€48.2 million CAPEX invested in H1 2023

More than 20% of revenue generated through lithium-ion solutions

US business now accounts for more than 20% of total Group revenue, mainly driven by lithium-ion solutions

Workforce grew organically and inorganically by around 90% to more than 3,244 employees

€76.9million expenditure for salaries, benefits, and taxes in H1 2023 (VS €28 million in H1 2022): approx. 175% increase

Sunlight Group, member of the international investment "Olympia" Group, has achieved a strong financial performance in the first half of 2023, confirming the company’s sustainable dynamic corporate development. While revenue increased by 201.5%, earnings also improved significantly by 141%, with considerable investments in many forward-looking innovations at the same time. In particular, the first half of 2023 was characterized by extensive M&A transactions, acceleration of the innovation program and sustainable volume growth. A total of €93.2 million was invested in the first two quarters in M&A related activities. €48.2 million have been invested in H1 2023 in CAPEX, mainly towards the lithium-ion and lead acid production expansion. Sunlight’s diversified and fully funded investment plan focuses on production facilities and infrastructure, advancing both lithium and lead production capacity, as well as major R&D projects on lithium batteries and cell technology.

On track to become a Global Energy Storage Solutions Champion

By these achievements in the first half year of 2023, the Sunlight Group has sustained its impressive growth in the third consecutive year. The company has accelerated its organizational and economic development. Revenue in the first six months amounted to €551.5 million, following €183 million in the same period of the previous year. This growth was mainly driven by the first-time consolidation of recently acquired business, a volume increase, especially in the North American market, and the high demand for innovative New Energy Solutions of the Group.

The global economy faced persistently high inflation, driven by rising energy costs and general increase in the prices across all materials and services. This inflation caused a significant increase in industrial production costs, which were only partially offset by price adjustments towards the customer base. This decision has been taken with a clear mission to protect the customer base and allow everyone to adjust to the new reality of costs. As a result, this affected the profitability of the Group but at the same time served as a testament Sunlight’s ability to support the customer base in rough times. Despite not being impacted, on the revenue side, by reduced regional trade activity due to the war in Ukraine, the Group's strong market positioning and customer base have shielded it from immediate consequences. However, it now confronts a challenging economic landscape characterized by increased uncertainty stemming from high interest rates and a subdued customer activity and investment climate in its primary markets.

Commenting on the release of the H1 2023 financial results, Lampros Bisalas, CEO of Sunlight Group, noted:” 2023 marks another significant step forward in fulfilling Sunlight Group's ambitions in the global energy storage market. Our remarkable growth over the past three years, despite a challenging market environment with consecutive major global and regional crises, demonstrates the trust our customers have placed in our ability to deliver innovative, high-quality, and competitive products. Undoubtedly, our best days lie ahead and the work we do now is going to deliver sustainable high growth rates in the years to come. The four plus one strategic pillar – Industrial Mobility in both lead and lithium, Energy Storage for Renewables, Recycling in both lead and lithium, the development and manufacturing of lithium-ion cells at a Gigafactory scale and the vertical integration on strategic components are all in full deployment, each in different stages of maturity, positioning our Group uniquely within the industry.

We remain confident that the Group is well-positioned, boasting a robust and growing customer base, an industry-leading innovation program, and a highly skilled, world-class team to successfully reach its mid-to-long-term objectives. With the support from our Shareholders and Board of Directors, we are focused in delivering on our priorities. The group continues to invest large amounts of funds supported by our balance sheet, in both OPEX and CAPEX, towards innovation programs in lithium-ion technologies, with expected revenue generation to be not earlier than two, three or even 4 years later. We firmly believe that these strategic investments are essential for shaping the future of our Group as a leading provider of Energy Storage Solutions in the world, with particular focus in Europe, Americas and Southeast Asia-Oceania.”

Facing further opportunities for dynamic growth, the company continues to build up a strong, talented, and skilled workforce. As of 31 June 2023, the Group employed a total of 3,244 people, 1,689 more than in 2022, corresponding to an increase of 90.9%. As a result of the latest M&A activities, Sunlight becomes ever more international and diversified; as of the balance sheet date, June the 30th 2023, 56.2% of the employees are located outside of Greece. Especially in Germany (due to the Triathlon and A. Mueller acquisitions) and in the US the share of employees increased significantly in the first half of the year. The company's expenses for salaries, benefits and taxes totaled €76.9 million in the first half of 2023, an increase of 174.7% compared to the €28 million in the same period of the previous year. The Sunlight Group has also entered a new dimension in employee training. In the first half of the year, the Group provided more than 16,600 hours of training to its employees. This is an increase of about 48% compared to the previous year.